Gearhart, U.S. Bank seek priority in Neacoxie Barn foreclosure proceeds

Published 11:05 am Tuesday, June 16, 2020

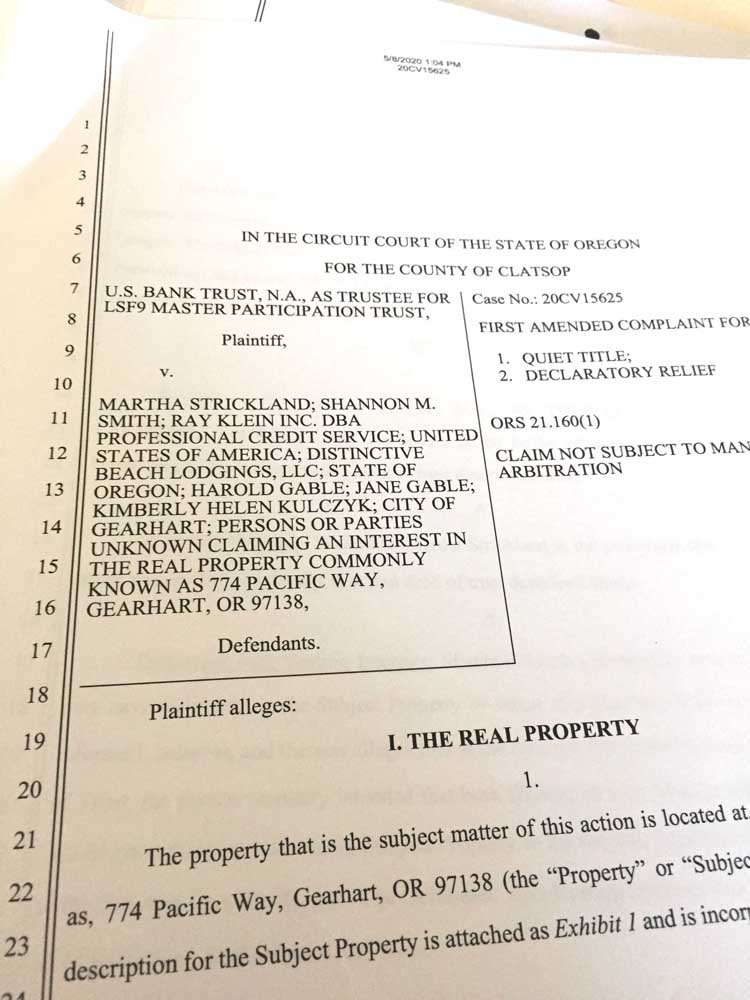

- U.S. Bank Trust document

A legal battle between representatives of U.S. Bank Trust, Gearhart and others potentially having an interest in Neacoxie Barn — a property under the microscope for improper commercial use — is underway.

The bank, through its legal representative, McCarthy Holthus LLP in Portland, asked the Clatsop County Circuit Court in May to declare the bank’s interest as senior to that of all other parties, including the city, state, numerous local residents and professional credit service agencies.

Since Gearhart received a 2016 court judgment related to fees, taxes and fines stemming from violations at the barn, the city believes its lien should be given priority and paid out of any sale or foreclosure proceedings, City Attorney Peter Watts said.

The liens amount to “just over $25,000” from an unpaid water bill and several administrative penalties, City Administrator Chad Sweet said.

In July 2007, Gearhart residents Shannon Smith and Martha Strickland signed and delivered a promissory note purchasing the property for $625,000 from owners Jerry and Bonnie Eller.

A subsequent lending document, filed in August 2007 for $417,000 with Wells Fargo, includes only Strickland’s name.

In a May filing, U.S. Bank Trust alleges that whether due to “mistake, inadvertence, or oversight” it was the intent of Smith to grant her interest in the property along with Strickland in the August 2007 document.

Watts said it does not appear that U.S. Bank Trust’s mortgage was recorded on Smith’s one-half interest in the property. The city “believes that its lien has priority over U.S. Bank’s lien (to the extent that U.S. Bank has one),” he wrote.

Whether or not Smith’s name was left off a lien for the bank’s property “is unknown,” the city wrote in a legal response last week, and the city’s position as senior to any other creditor, including U.S. Bank Trust, “should not be harmed.”

“We believe that filing an answer was a necessary step to protect our lien,” Watts said.

Since 2012, the barn’s owners have been fined for renting out the property for weddings and other public functions without a valid certificate of occupancy.

The first $5,000 fine was reduced by the City Council to $1 after owners said they would follow city rules prohibiting commercial events.

Subsequent fines followed as commercial use continued until a Circuit Court judge issued an injunction in 2016 prohibiting commercial events.

In February 2017, a foreclosure auction was canceled and a refinance was in process, Smith said at the time.

Neacoxie Barn is not on the market, according to the real estate website Zillow, which places a $397,000 value on the property.

Smith and representatives of U.S. Bank Trust did not return requests for comment