Seaside files suit against Shilo Inn

Published 6:02 am Thursday, December 15, 2016

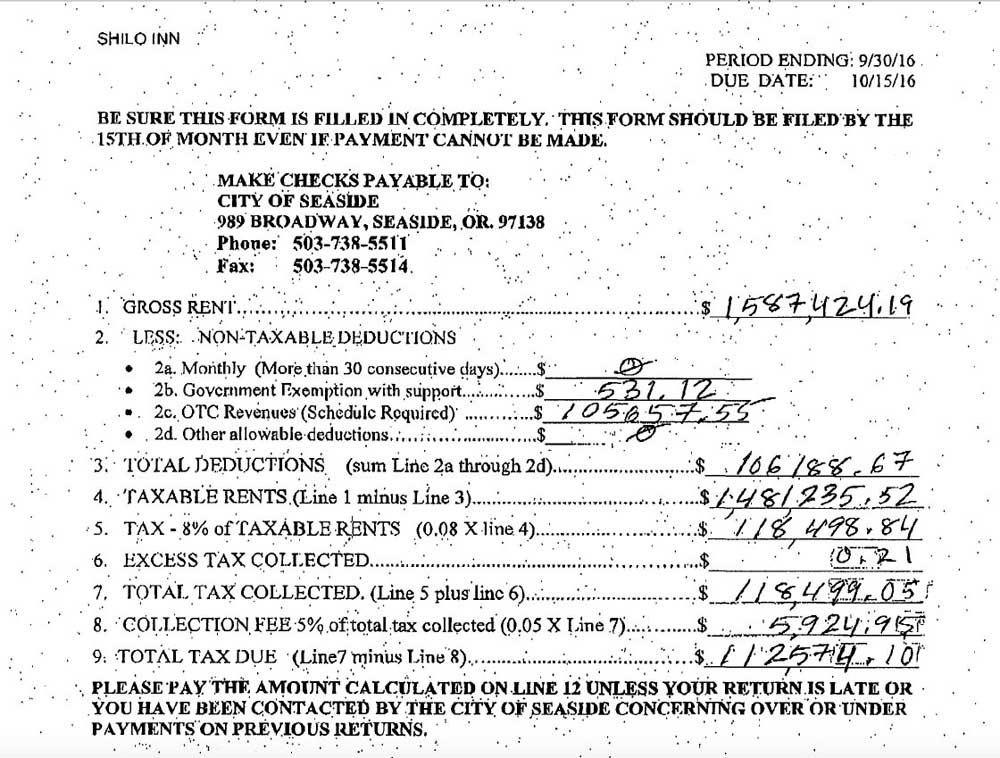

- “Exhibit A” shows Shilo's income and tax bill.

Shilo Inn owes Seaside more than $100,000 in lodging taxes, and the city went to court this month to collect.

The complaint in Clatsop County Circuit Court asks for delinquent taxes of $112,574, with interest of 1 percent per month and an additional penalty of nearly $17,000. It is the third time the city has sued Shilo for back taxes this year.

Trending

“If you’ve looked at the complaint that I’ve filed, this is the third time I’ve had to do that within the last five or six months,” City Attorney Dan Van Thiel said. “I take the position that any of the hotels or anybody who has the responsibility to collect that money is a fiduciary. That’s the city’s money.”

Altogether, the city is seeking to collect almost $143,000 in tax, penalties and interest on Shilo’s taxable room rentals of almost $1.5 million.

Penalties and interest continue to accrue on the 113-room beachfront hotel in Seaside.

“It certainly is a significant amount of money,” Van Thiel said. “It evidently is not enough because they don’t turn over the tax everybody pays when they stay at the Shilo Inn.”

Shilo Inn, Seaside Oceanfront LLC paid out almost $146,000 — a late payment of more than $54,000 delivered in July and a late payment of $93,000 in delinquent room taxes, interest and penalties this fall — after two similar suits brought by the city. Those cases were closed after payments were made.

A lawyer for Shilo Inn did not respond to a request for comment.

Shilo Inn was founded in 1974 by Mark Hemstreet. The 47-hotel chain, headquartered in Portland, struggled after the Sept. 11, 2001, attacks interrupted the tourist industry.

In 2002, more than half of Shilo Inns in nine states sought bankruptcy protection before re-emerging after reaching a deal with creditors.

The Great Recession brought more closings to the Shilo Inn chain, which included both the Seaside Oceanfront and Seaside East on Holladay Drive.

In 2015, Shilo’s federal bankruptcy cases resulted in a restructuring deal and the sale of some Shilo properties, including the sale of Shilo Inn Seaside East.

The city was not a part of the federal proceedings, Van Thiel said.

Shilo Inn brought in gross rents of about $1.4 million in taxable rents in Seaside for the period ending Sept. 30, of which 8 percent is subject to the city’s room tax collection.

In January, the room tax for all hotels and motels increases to 10 percent, with the hike to fund Seaside Civic and Convention Center upgrades.

Van Thiel said he has had trouble on occasion collecting lodging taxes, but “it’s been some time” since delinquency has led to court action.

“In the previous two times, (Shilo) paid the money,” Van Thiel said. “And I expect them to this time. They don’t have any defenses to it. I’m not going to let them sit there and fool around.”